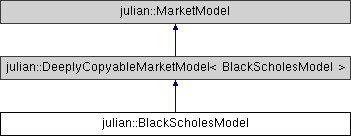

Class implements Black Scholes model. More...

#include <BlackScholesModel.hpp>

Public Member Functions | |

| BlackScholesModel () | |

| Default Constructor. More... | |

| BlackScholesModel (const Date &date, const double &asset_prize, const SmartPointer< ir::Curve > &discounting_curve, const SmartPointer< ir::Curve > ÷nd_curve, const SmartPointer< Volatility > &volatility) | |

| Constructor. More... | |

| virtual Date | getDate () const override |

| returns the date on which market data are actual More... | |

| virtual double | getAssetPrize () const override |

| returns the prize of asset More... | |

| virtual SmartPointer< ir::Curve > | getDiscountingCurve () const override |

| returns discounting curve More... | |

| virtual SmartPointer< ir::Curve > | getDividendCurve () const override |

| returns dividend curve More... | |

| virtual void | setDate (Date &) override |

| sets the market date More... | |

| virtual void | setAssetPrize (double) override |

| sets asset prize More... | |

| virtual void | bumpAssetPrize (double) override |

| bump asset prize additively More... | |

| virtual void | bumpVolatility (double) override |

| bump volatility additively More... | |

| double | prizeAnalytically (const EuropeanOpt &) const override |

| method calculates the prize of European vanilla option More... | |

Public Member Functions inherited from julian::DeeplyCopyableMarketModel< BlackScholesModel > Public Member Functions inherited from julian::DeeplyCopyableMarketModel< BlackScholesModel > | |

| virtual MarketModel * | clone () const |

| virtual copy constructor More... | |

Public Member Functions inherited from julian::MarketModel Public Member Functions inherited from julian::MarketModel | |

| virtual | ~MarketModel () |

| destructor More... | |

Private Member Functions | |

| double | calculateDrift (Date) const |

| basing on discounting and dividend curve exponential drift is calculated More... | |

Private Attributes | |

| Date | date_ |

| Market date. More... | |

| double | asset_prize_ |

| Underlying asset prize. More... | |

| SmartPointer< ir::Curve > | discounting_curve_ |

| Curve used to discount CFs. More... | |

| SmartPointer< ir::Curve > | dividend_curve_ |

| Curve used to estimate continuous dividend. More... | |

| SmartPointer< Volatility > | volatility_ |

| Volatility of the asset prize. More... | |

Detailed Description

Class implements Black Scholes model.

PDE

![\[{\frac {\partial V}{\partial t}}+{\frac {1}{2}}\sigma ^{2}S^{2}{\frac {\partial ^{2}V}{\partial S^{2}}}+rS{\frac {\partial V}{\partial S}}-rV=0\]](form_99.png)

SDE

![\[dS_t = (r-q) S_t dt + \sigma S_t dW_t^Q\]](form_100.png)

For more information see: [14] [15] [20] [18]

and links

- Examples:

- optionPricingExample.cpp.

Constructor & Destructor Documentation

|

inline |

Default Constructor.

|

inline |

Constructor.

Member Function Documentation

|

overridevirtual |

|

overridevirtual |

bump volatility additively

- Parameters

-

h bump size

- Note

- Depending on the implementation of volatility bumping may have different mechanism

Implements julian::MarketModel.

|

private |

basing on discounting and dividend curve exponential drift is calculated

|

overridevirtual |

returns the prize of asset

Implements julian::MarketModel.

|

overridevirtual |

returns the date on which market data are actual

Implements julian::MarketModel.

|

overridevirtual |

returns discounting curve

Implements julian::MarketModel.

|

overridevirtual |

returns dividend curve

Implements julian::MarketModel.

|

overridevirtual |

method calculates the prize of European vanilla option

![\[ \begin{aligned} C & = i_{cp} (S e^{-q T_{today,maturity} }N(i_{cp} d_{1}) - K e^{-r T_{today,maturity}} N(i_{cp}d_{2})) \\ d_{1} & = \frac{ln(\frac{S}{K}) + (r - q) T_{today,maturity} + \frac{var}{2} }{\sqrt{var}} \\ d_{2} & = \frac{ln(\frac{S}{K}) + (r - q) T_{today,maturity} - \frac{var}{2} }{\sqrt{var}} \\ var & = \sigma^2(K, expiry) T_{today, expiry} \end{aligned}\]](form_92.png)

where:

asset prize

asset prize strike

strike volatility

volatility discounting rate, return on asset

discounting rate, return on asset 1 for Call option; -1 for put option

1 for Call option; -1 for put option standard normal distribution

standard normal distribution

Implements julian::MarketModel.

|

overridevirtual |

sets asset prize

- Parameters

-

input new asset prize

Implements julian::MarketModel.

- Examples:

- optionPricingExample.cpp.

|

overridevirtual |

Member Data Documentation

|

private |

Underlying asset prize.

|

private |

Market date.

|

private |

Curve used to discount CFs.

|

private |

Curve used to estimate continuous dividend.

|

private |

Volatility of the asset prize.

The documentation for this class was generated from the following files:

- C:/Unix/home/OEM/jULIAN/src/marketModels/BlackScholesModel.hpp

- C:/Unix/home/OEM/jULIAN/src/marketModels/BlackScholesModel.cpp

1.8.11

1.8.11