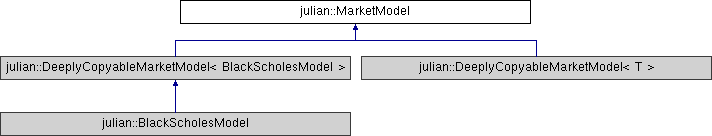

Interface for objects representing market models. More...

#include <marketModel.hpp>

Public Member Functions | |

| virtual Date | getDate () const =0 |

| returns the date on which market data are actual More... | |

| virtual double | getAssetPrize () const =0 |

| returns the prize of asset More... | |

| virtual SmartPointer< ir::Curve > | getDiscountingCurve () const =0 |

| returns discounting curve More... | |

| virtual SmartPointer< ir::Curve > | getDividendCurve () const =0 |

| returns dividend curve More... | |

| virtual void | setDate (Date &date)=0 |

| sets the market date More... | |

| virtual void | setAssetPrize (double prize)=0 |

| sets asset prize More... | |

| virtual void | bumpAssetPrize (double h)=0 |

| bump asset prize additively More... | |

| virtual void | bumpVolatility (double h)=0 |

| bump volatility additively More... | |

| virtual double | prizeAnalytically (const EuropeanOpt &opt) const =0 |

| prize EuropeanOpt analytically More... | |

| virtual MarketModel * | clone () const =0 |

| virtual copy constructor More... | |

| virtual | ~MarketModel () |

| destructor More... | |

Detailed Description

Interface for objects representing market models.

Market model is an object holding information about market state (interest rates, yields, volatility, asset prize) and its dynamics (usually represented by stochastic process).

Constructor & Destructor Documentation

|

inlinevirtual |

destructor

Member Function Documentation

|

pure virtual |

|

pure virtual |

bump volatility additively

- Parameters

-

h bump size

- Note

- Depending on the market model bumping volatility may have different mechanism

Implemented in julian::BlackScholesModel.

|

pure virtual |

virtual copy constructor

Implemented in julian::DeeplyCopyableMarketModel< T >, and julian::DeeplyCopyableMarketModel< BlackScholesModel >.

|

pure virtual |

returns the prize of asset

Implemented in julian::BlackScholesModel.

|

pure virtual |

returns the date on which market data are actual

Implemented in julian::BlackScholesModel.

|

pure virtual |

returns discounting curve

Implemented in julian::BlackScholesModel.

|

pure virtual |

returns dividend curve

Implemented in julian::BlackScholesModel.

|

pure virtual |

prize EuropeanOpt analytically

Implemented in julian::BlackScholesModel.

|

pure virtual |

|

pure virtual |

The documentation for this class was generated from the following file:

- C:/Unix/home/OEM/jULIAN/src/marketModels/marketModel.hpp

1.8.11

1.8.11