optionPricingExample.cpp

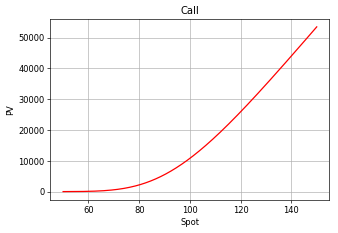

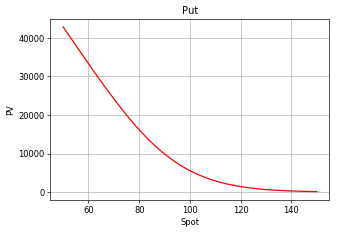

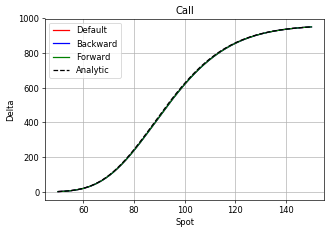

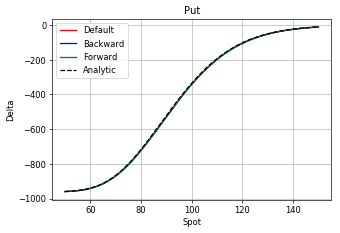

This example show how to price option using Black-Scholes model.

|

|

|

|

|

|

|

|

#include <juliant.hpp>

using namespace julian;

int main() {

//

// Defining auxiliary objects

//

Date today(2018,APR,26);

PLNHoliday holiday;

.addHoliday(holiday)

.withSpotLag(2);

InterestRate rate;

ACT365 yf;

//

// Creating market model

//

ir::FlatCurve curve1(rate, 0.05, today, calendar);

ir::FlatCurve curve2(rate, 0.02, today, calendar);

FlatVolatility volatility(today, 0.15, yf);

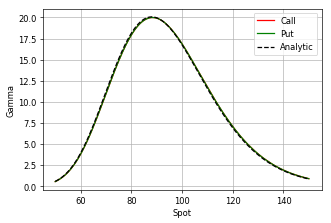

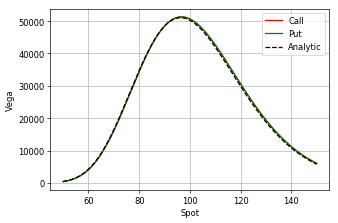

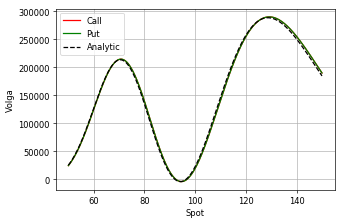

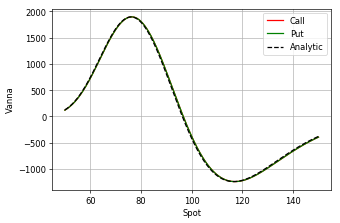

BlackScholesModel model(today, 100.0, curve1, curve2, volatility);

//

// Creating option

//

auto exp = today + 2*YEAR;

EuropeanOpt option_c(today, today, exp, exp, 1000.0, 100.0, CALL);

EuropeanOpt option_p(today, today, exp, exp, 1000.0, 100.0, PUT);

//

// Creating pricer and greeks report

//

AnalyticalPricingEngine pricer;

.withDelta()

.withGamma()

.withVega()

.withVolga()

.withVanna()

.withTheta()

.build();

//

// Performing calculations

//

DataFrame df;

for (double s = 50.0; s <= 150.0; s += 0.25) {

model.setAssetPrize(s);

DataEntryClerk input;

input.add(greeks);

df.append(input);

}

for (double s = 50.0; s <= 150.0; s += 0.25) {

model.setAssetPrize(s);

auto greeks = risks->getRisks(model, pricer, option_p);

DataEntryClerk input;

input.add("Spot", s);

input.add(greeks);

df.append(input);

}

}

1.8.11

1.8.11