Pricing engines for options. Pricing engines are classes that are used to generate the PV and Greeks for a given product using provided market model.. More...

Modules | |

| Analytical Engines | |

| Analytical pricing engines. | |

| PV and Greeks | |

| Definition of classes that are used to construct risk reports about options PV and Greeks. | |

Classes | |

| class | julian::PricingEngine |

| Interface for all pricing engines. More... | |

| class | julian::DeeplyCopyablePricingEngine< T > |

| Class uses Curiously Recurring Template Pattern to implement polymorphic copy construction in every derived class implementing PricingEngine. More... | |

Functions | |

| double | julian::prizeBlackScholes (double S, double K, double DFr, double DFq, double vol, double t, CallPut icp) |

| Function calculates prize of European option using Black-Scholes formula. More... | |

| double | julian::calculateImpliedVolatility (double S, double K, double DFr, double DFq, double prize, double t, CallPut icp) |

| Function calculates implied volatility. More... | |

| double | julian::calculateBlackScholesDelta (double S, double K, double DFr, double DFq, double vol, double t, CallPut icp) |

| Function calculates delta parameter of European option. More... | |

| double | julian::calculateStrikeFromCallDelta (double spot, double DFr, double DFq, double vol, double t, double delta) |

| Function calculates delta parameter of European option. More... | |

| double | julian::calculateStrikeFromPutDelta (double spot, double DFr, double DFq, double vol, double t, double delta) |

| Function calculates delta parameter of European option. More... | |

Detailed Description

Pricing engines for options. Pricing engines are classes that are used to generate the PV and Greeks for a given product using provided market model..

Function Documentation

| double julian::calculateBlackScholesDelta | ( | double | S, |

| double | K, | ||

| double | DFr, | ||

| double | DFq, | ||

| double | vol, | ||

| double | t, | ||

| CallPut | icp | ||

| ) |

Function calculates delta parameter of European option.

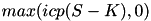

Function uses BS formula:

![\[ \begin{aligned} C & = i_{cp} \times S \times DFq \times N(i_{cp} d_{1}) \\ d_{1} & = \frac{ln(\frac{S\frac{DFq}{DFr}}{K}) + \frac{var}{2} t}{\sqrt{var}} \\ var & = vol^2 t \end{aligned}\]](form_242.png)

- Parameters

-

S asset prize K strike DFr discount factor DFq capitalization of asset prize vol volatility of asset prize t time in years icp Call/Put, equals 1 for Call and -1 for Put

- Returns

- delta of European Option paying

at time T

at time T

| double julian::calculateImpliedVolatility | ( | double | S, |

| double | K, | ||

| double | DFr, | ||

| double | DFq, | ||

| double | prize, | ||

| double | t, | ||

| CallPut | icp | ||

| ) |

Function calculates implied volatility.

Function uses BracketingRootFinder::BRENT_DEKKER algorithm to find the value of volatility that match Black-Scholes prize with market prize. Function uses julian::prizeBlackScholes function

- Parameters

-

S asset prize K strike DFr discount factor DFq capitalization of asset prize prize option's prize t time in years icp Call/Put, equals 1 for Call and -1 for Put

- Returns

- implied volatility

| double julian::calculateStrikeFromCallDelta | ( | double | spot, |

| double | DFr, | ||

| double | DFq, | ||

| double | vol, | ||

| double | t, | ||

| double | delta | ||

| ) |

Function calculates delta parameter of European option.

Function uses BS formula:

![\[ \frac{DFq}{DFr} \times spot * exp^{ N^{-1}( delta / DFq) \times vol \times sqrt(t) - 0.5 \times vol \times vol \times t}\]](form_243.png)

where  is inverse CDF of normal distribution

is inverse CDF of normal distribution

- Parameters

-

spot asset prize DFr discount factor DFq capitalization of asset prize vol volatility of asset prize t time in years delta delta of call

- Returns

- strike of European option

| double julian::calculateStrikeFromPutDelta | ( | double | spot, |

| double | DFr, | ||

| double | DFq, | ||

| double | vol, | ||

| double | t, | ||

| double | delta | ||

| ) |

Function calculates delta parameter of European option.

Function uses BS formula:

![\[ \frac{DFq}{DFr} \times spot * exp^{-( N^{-1}( -delta / DFq) \times vol \times sqrt(t) - 0.5 \times vol \times vol \times t)}\]](form_245.png)

where  is inverse CDF of normal distribution

is inverse CDF of normal distribution

- Parameters

-

spot asset prize DFr discount factor DFq capitalization of asset prize vol volatility of asset prize t time in years delta delta of call

- Returns

- strike of European option

| double julian::prizeBlackScholes | ( | double | S, |

| double | K, | ||

| double | DFr, | ||

| double | DFq, | ||

| double | vol, | ||

| double | t, | ||

| CallPut | icp | ||

| ) |

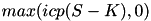

Function calculates prize of European option using Black-Scholes formula.

Function uses BS formula:

![\[ \begin{aligned} C & = i_{cp} (S \times DFq \times N(i_{cp} d_{1}) - K \times DFr \times N(i_{cp}d_{2})) \\ d_{1} & = \frac{ln(\frac{S\frac{DFq}{DFr}}{K}) + \frac{var}{2} t}{\sqrt{var}} \\ d_{2} & = \frac{ln(\frac{S\frac{DFq}{DFr}}{K}) - \frac{var}{2} t}{\sqrt{var}} \\ var & = vol^2 t \end{aligned}\]](form_240.png)

- Parameters

-

S asset prize K strike DFr discount factor DFq capitalization of asset prize vol volatility of asset prize t time in years icp Call/Put, equals 1 for Call and -1 for Put

- Returns

- prize of European Option paying

at time T

at time T

1.8.11

1.8.11