convergenceExample.cpp

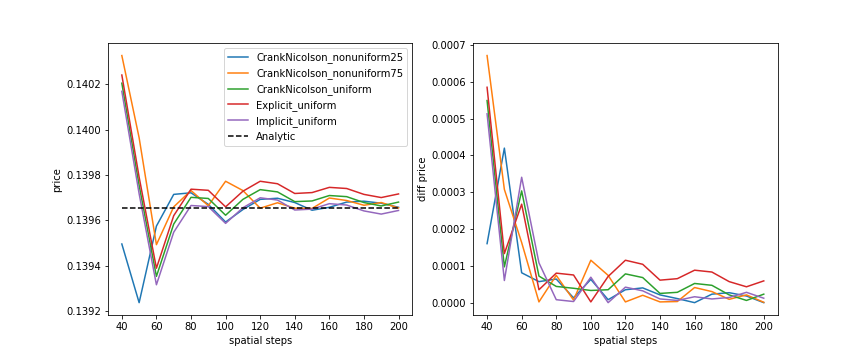

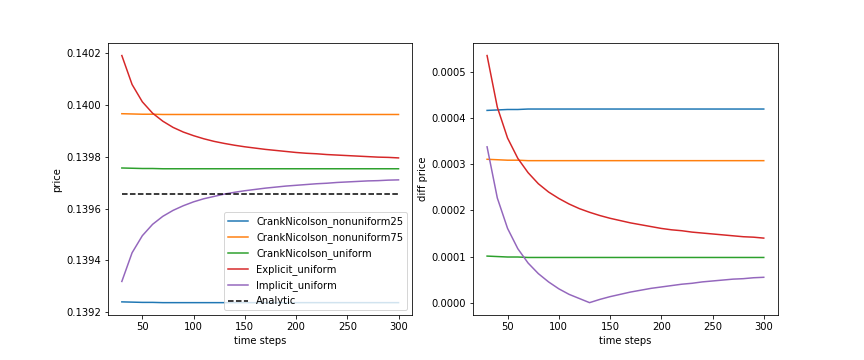

Example shows how model converges when different schemes and grids are chosen. We tested following settings:

- Explicit scheme with uniform grid

- Implicit scheme with uniform grid

- Crank-Nicolson scheme with uniform grid

- Crank-Nicolson scheme with non-uniform grid with low clustering

- Crank-Nicolson scheme with uniform grid with high clustering

We see that non-uniform grid converge faster for small number of spatial steps. For larger number of spatial steps the differences between schemes are small.

In case of number of time steps, we see advantage of Crank Nicolson scheme, for which even the small number of time steps ensures convergence. We see that solution differences from the analytical price. The difference is cause by using small number of spatial steps. Using larger number of spatial steps would cause the instability of explicit scheme for small number of time steps.

#include <marian.hpp>

using namespace marian;

int main() {

//

// Preparing building blocks of PDE solver

//

LUSolver solver;

UniformGridBuilder ugrid;

HSineGridBuilder nugrid1(0.75);

HSineGridBuilder nugrid2(0.25);

SpotRelatedRange range_setter(0.2, 3.0);

ExplicitScheme scheme_ex;

ImplicitScheme scheme_im;

CrankNicolsonScheme scheme_cn;

//

// Constructing option and market

//

double strike = 1.0;

double tenor = 1.0;

Market market;

market.spot = 1.05;

market.vol = 0.25;

market.r = 0.02;

//

// We will use analytical solution as benchmark

//

//

// Preparing pricers and performing test

//

FDMPricer pricer1(scheme_ex, solver, ugrid, ugrid, range_setter);

FDMPricer pricer2(scheme_im, solver, ugrid, ugrid, range_setter);

FDMPricer pricer3(scheme_cn, solver, ugrid, ugrid, range_setter);

FDMPricer pricer4(scheme_cn, solver, nugrid1, ugrid, range_setter);

FDMPricer pricer5(scheme_cn, solver, nugrid2, ugrid, range_setter);

DataFrame results_spatial;

for (int ns = 40; ns <= 200; ns += 10) {

double fdm_price2 = pricer2.price(market, option, ns, 350);

double fdm_price3 = pricer3.price(market, option, ns, 350);

double fdm_price4 = pricer4.price(market, option, ns, 350);

double fdm_price5 = pricer5.price(market, option, ns, 350);

DataEntryClerk input;

input.add("Analytic", analytic_price);

input.add("Explicit_uniform", fdm_price1);

input.add("Implicit_uniform", fdm_price2);

input.add("CrankNicolson_uniform", fdm_price3);

input.add("CrankNicolson_nonuniform75", fdm_price4);

input.add("CrankNicolson_nonuniform25", fdm_price5);

results_spatial.append(input);

}

DataFrame results_time;

for (int nt = 30; nt <= 300; nt += 10) {

double fdm_price1 = pricer1.price(market, option, 50, nt);

double fdm_price2 = pricer2.price(market, option, 50, nt);

double fdm_price3 = pricer3.price(market, option, 50, nt);

double fdm_price4 = pricer4.price(market, option, 50, nt);

double fdm_price5 = pricer5.price(market, option, 50, nt);

DataEntryClerk input;

input.add("NT", nt);

input.add("Analytic", analytic_price);

input.add("Explicit_uniform", fdm_price1);

input.add("Implicit_uniform", fdm_price2);

input.add("CrankNicolson_uniform", fdm_price3);

input.add("CrankNicolson_nonuniform75", fdm_price4);

input.add("CrankNicolson_nonuniform25", fdm_price5);

results_time.append(input);

}

results_time.printToCsv("convergenceExample2");

}

1.8.11

1.8.11